Lately, the allure of gold has captivated traders and collectors alike, leading to a significant rise in the acquisition of gold bars. This development is pushed by various components, including economic uncertainties, inflation concerns, and the want for tangible assets. As individuals search to diversify their portfolios and secure their wealth, gold bars have emerged as a well-liked alternative. This text explores the reasons behind this development, the advantages of investing money in gold in gold bars, and essential concerns for potential consumers.

The Financial Landscape

The global economy has confronted quite a few challenges in recent years, from the COVID-19 pandemic to geopolitical tensions and inflationary pressures. These elements have led many traders to hunt secure-haven belongings, with gold being a traditional choice. Gold has an extended history of maintaining its worth during economic downturns, making it an appealing possibility for those wanting to protect their wealth.

Moreover, central banks world wide have been increasing their gold reserves, further driving demand. This institutional buying has contributed to a bullish sentiment surrounding gold, prompting particular person traders to follow suit. If you have any inquiries pertaining to where to buy gold and how to use best place to buy online gold, you can get hold of us at our webpage. As uncertainty looms, the pattern of buying gold bars is more likely to proceed as people prioritize monetary security.

Some great benefits of Gold Bars

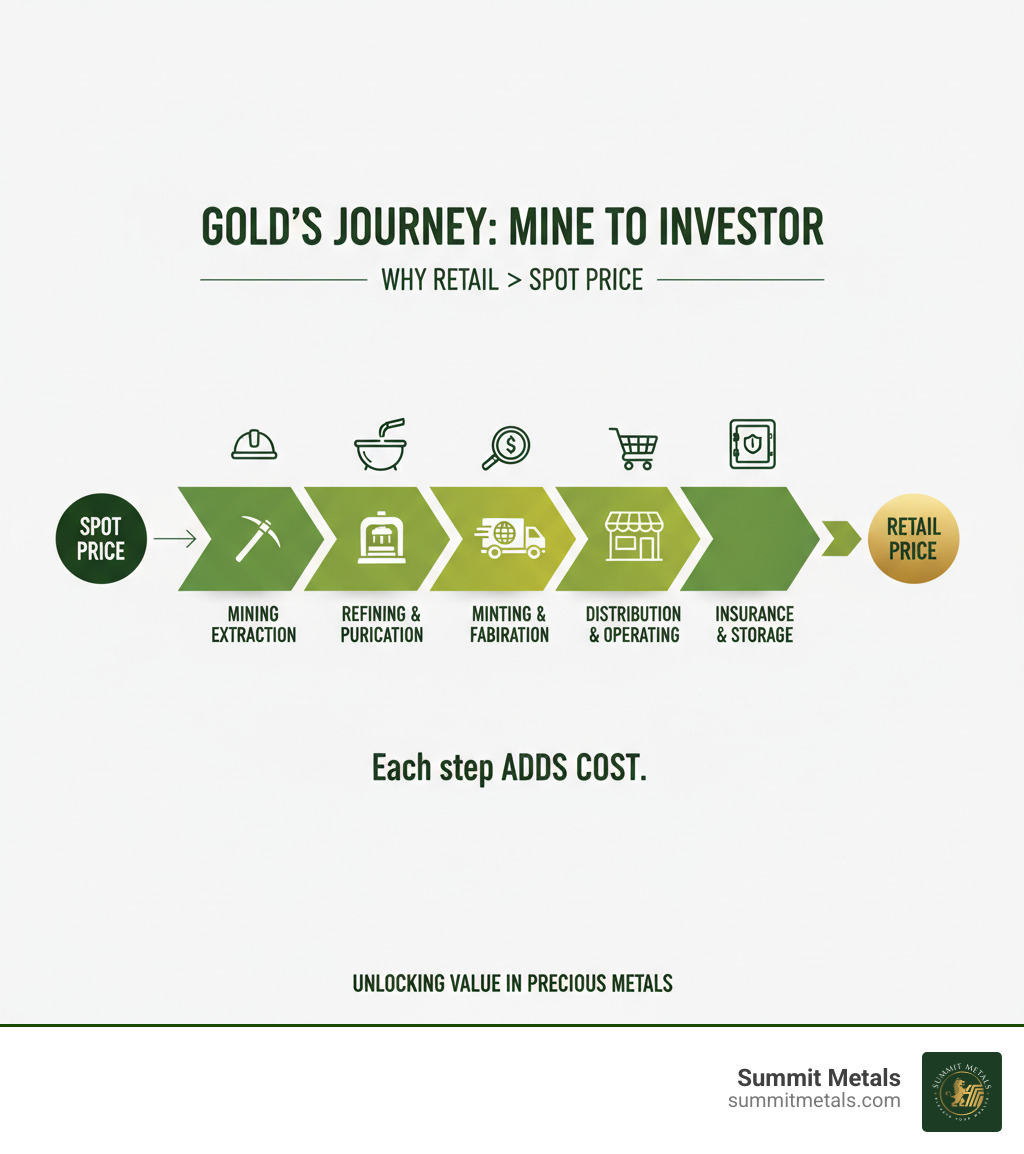

Investing in gold bars presents a number of advantages over other types of gold, such as coins or jewellery. One among the first advantages is the lower premium associated with gold bars. When purchasing gold in bar type, buyers typically pay a smaller markup over the spot worth compared to coins, which frequently carry larger premiums resulting from their collectible nature.

Gold bars are additionally easier to retailer and transport. They are available in various sizes, ranging from one ounce to larger 400-ounce bars, permitting investors to choose the quantity that best matches their wants. Additionally, gold bars are acknowledged globally, making them a universally accepted type of wealth.

One other important benefit is the liquidity of gold bars. In instances of financial distress, gold can be quickly transformed to money, providing investors with speedy access to funds. This liquidity is important for many who could have to sell their belongings throughout a financial disaster.

How to Buy Gold Bars

For those keen on purchasing gold bars, a number of avenues are available. The most common strategies embody shopping for from respected sellers, on-line marketplaces, and auctions. Before making a purchase, it's essential to conduct thorough research to ensure the seller's credibility and the authenticity of the gold bars.

When buying gold bars, potential investors ought to consider the next elements:

- Purity and Certification: Gold bars are typically measured in karats, with 24-karat gold being the purest form. Search for bars that come with certification from recognized institutions, such because the London Bullion Market Affiliation (LBMA), which ensures the bar's authenticity and purity.

- Reputable Dealers: Choose dealers with a strong status in the industry. Learn reviews, examine their credentials, and ensure they have a transparent shopping for course of. Respected dealers usually provide buyback choices, which will be helpful sooner or later.

- Storage Options: Consider how you will retailer your gold for sale in usa bars. Whereas some individuals choose to maintain their gold at house in a secure, others opt for safe storage services provided by banks or specialised companies. Correct storage is vital to protect your funding from theft or damage.

- Market Timing: Like all funding, timing can considerably impact the price of gold. Monitor market trends and consider purchasing during dips in worth to maximise your investment.

- Prices and Fees: Remember of any further prices related to buying gold bars, including shipping fees, taxes, and supplier premiums. Understanding the whole price will enable you make knowledgeable choices.

The way forward for Gold Investment

As the global financial landscape continues to evolve, the way forward for gold funding remains promising. Analysts predict that gold will maintain its status as a protected-haven asset, especially in times of uncertainty. Moreover, the increasing popularity of gold-backed monetary products, such as alternate-traded funds (ETFs), might further fuel demand for physical gold, including bars.

Moreover, the rise of digital currencies and blockchain expertise has sparked curiosity in gold as a hedge towards potential volatility within the cryptocurrency market. Many buyers view gold as a stable different, leading to a possible improve in gold bar purchases.

Conclusion

The development of buying gold bars is gaining momentum as traders search to safeguard their wealth in an unpredictable financial surroundings. With various advantages, including lower premiums, ease of storage, and liquidity, buy gold silver online bars have turn into a sexy choice for both seasoned buyers and newcomers alike.

As you consider coming into the gold market, remember to conduct thorough research, select reputable sellers, and stay knowledgeable about market developments. By doing so, you can make informed decisions that align together with your monetary goals and ensure a secure investment in this timeless asset. Whether you are looking to diversify your portfolio or just want to personal a chunk of tangible wealth, gold bars could also be the perfect addition to your investment technique.