In recent times, the funding panorama has seen a notable shift in direction of various assets, with gold emerging as a favored selection among buyers. Significantly, the idea of investing in gold via Particular person Retirement Accounts (IRAs) has gained traction. This article aims to explore the trends, benefits, and challenges associated with IRA gold investing, drawing on observational research to present a complete overview.

The Rise of Gold Investing

Gold has been an emblem of wealth and a hedge against inflation for centuries. In the wake of economic uncertainty, geopolitical tensions, and fluctuating inventory markets, many investors are turning to gold as a secure options for gold-backed ira rollover haven. The current pandemic has further accelerated this trend, as individuals seek to diversify their portfolios and protect their retirement savings.

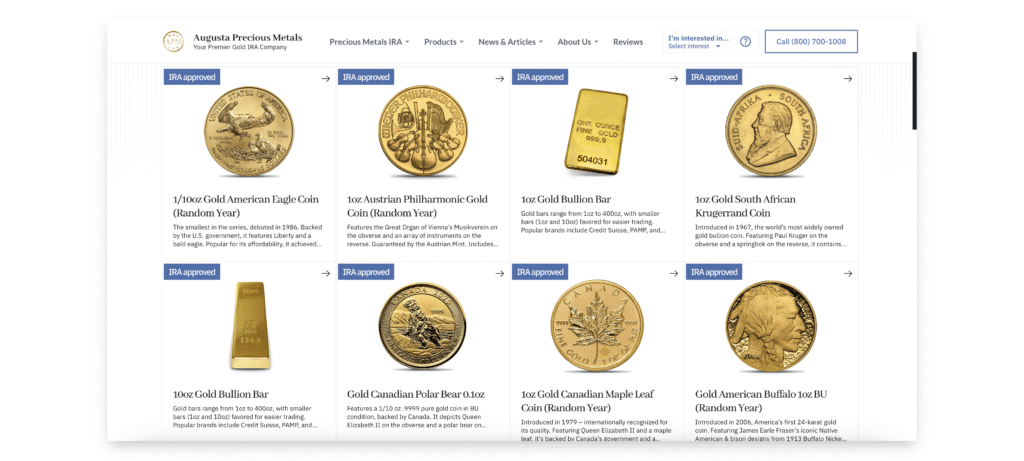

The internal Revenue Service (IRS) permits for particular forms of gold to be held within a self-directed IRA. This consists of gold bullion, coins, and different accredited forms of valuable metals. As a result, gold IRAs have seen a surge in popularity, with many monetary corporations reporting elevated inquiries and account openings.

Traits in IRA Gold Investing

Observational information signifies that a growing number of buyers are incorporating leading gold ira investment firms into their retirement plans. In keeping with a survey conducted by a leading firms for ira precious metals rollover investments funding agency, about 30% of investors now consider gold a important part of their retirement strategy. When you adored this informative article and also you want to receive guidance regarding recommended firms for retirement investments generously go to the web site. This shift is particularly evident amongst millennials and Technology X, who're more inclined to hunt various investments compared to their predecessors.

Moreover, the attraction of gold IRAs just isn't restricted to particular person buyers. Monetary advisors are more and more recommending gold as a viable asset class for retirement portfolios. This trend displays a broader acceptance of diversification strategies that embrace tangible assets.

Advantages of IRA Gold Investing

- Hedge Against Inflation: Certainly one of the primary reasons for investing in gold is its historical efficiency as a hedge against inflation. As the price of residing rises, gold tends to keep up its worth, offering a safeguard for retirement savings.

- Portfolio Diversification: Gold presents a unique alternative for diversification within an investment portfolio. By including gold to a mix of stocks, bonds, and different assets, investors can scale back general portfolio threat and improve potential returns.

- Tax Advantages: Investing in gold by an IRA provides sure tax benefits. Beneficial properties from the sale of gold held in an IRA are tax-deferred until withdrawal, permitting investors to grow their wealth with out quick tax implications.

- Tangible Asset: Unlike stocks or bonds, gold is a bodily asset that investors can hold. This tangibility can provide peace of mind, especially throughout instances of economic instability.

- Liquidity: Gold is a highly liquid asset, that means it can be simply purchased and offered. This liquidity is advantageous for buyers trying to entry their funds when wanted.

Challenges of IRA Gold Investing

Regardless of the benefits, IRA gold investing isn't with out its challenges. Observational research highlights several key points that potential investors should consider:

- Storage and Security: Gold held inside an IRA should be saved in an accepted depository, which might incur extra prices. Traders should additionally consider the security of their funding, as physical gold might be inclined to theft.

- Higher Charges: Establishing and maintaining a gold IRA might be costlier than traditional IRAs. Investors might face greater charges for account administration, storage, and insurance, which can eat into potential returns.

- Market Volatility: Whereas gold is usually considered as a stable funding, its price can be volatile. Traders should be prepared for fluctuations available in the market and perceive the factors that may affect gold costs.

- Limited Investment Choices: Not like traditional IRAs, which supply a variety of investment recommended options for retirement precious metals iras, gold IRAs are restricted to particular sorts of gold and other permitted precious metals. This limitation can restrict funding strategies.

- Regulatory Considerations: The IRS has strict laws regarding the varieties of gold that may be held in an IRA. Buyers should guarantee they comply with these rules to avoid penalties and ensure the tax-advantaged status of their funding.

Conclusion

The pattern of IRA gold investing reflects a broader shift in direction of different assets within the funding panorama. As economic uncertainties continue to loom, many investors are turning to gold as a means of defending their retirement savings. Whereas there are important benefits to incorporating gold into an IRA, potential buyers must also remember of the challenges and prices related to this technique.

As the market for gold continues to evolve, ongoing observational research can be important in understanding the dynamics of IRA gold investing. By staying knowledgeable about developments, benefits, and challenges, traders could make educated choices that align with their financial targets and retirement plans. Finally, gold stays a compelling choice for these in search of to diversify their portfolios and safeguard their monetary futures.